Why Traditional Inventory Audits Are Failing Convenience Store Owners

Every few weeks, the same routine repeats in many convenience stores. The back office door closes. Staff count shelves, coolers, and backroom stock. Numbers are compared with the POS. Gaps appear. Orders are adjusted based on whatever seems closest to reality.

By the next audit, the same items show the same issues.

This is why inventory audits for convenience store owners often feel repetitive and ineffective. They promise clarity, but in real operations, they turn into a cycle of counting without correction.

What Inventory Audits Are Meant to Do

Inventory audits are supposed to answer a simple question: Do I actually have what my system says I have?

Inventory audits for convenience store operations are periodic checks that compare physical stock with POS data to understand what inventory exists, what it is worth, and where discrepancies occur.

For store owners, inventory audits for convenience store operations are used to:

- Estimate store and category valuation

- Identify dead stock and slow-moving items

- Spot fast-moving products

- Support ordering decisions for global and local items

Within convenience store inventory management, audits are expected to guide decisions. In reality, they function as one-time checkpoints before ordering, not as tools for control.

Where the Traditional Inventory Audit Process Breaks Down

As stores grow in size and complexity, weaknesses of the Traditional inventory audit process become clear. These weaknesses explain why audits fail to prevent repeat losses, despite being performed regularly.

1. Rough valuation, not reliable valuation

Manual audits often rely on approximate counts and outdated item data. Small errors across thousands of SKUs lead to incorrect valuation and poor investment decisions.

2. No learning from past audits

Each audit stands alone. Data from previous audits is rarely analysed. Patterns related to convenience store inventory shrink go unnoticed, so the same losses repeat month after month.

3. Inventory reconciliation problems remain unresolved

Audits highlight mismatches between physical stock and POS data but do not explain why they occur. These ongoing inventory reconciliation problems create confusion during ordering and planning.

4. Bloated POS systems

Many stores maintain 15,000 to 20,000 items in their POS, even though only 10–15 percent actively sell. This hurts productivity and weakens convenience store inventory management.

5. Local products stay invisible

Without UPC codes, local items are difficult to track. This increases the risk of convenience store inventory shrink and revenue leakage.

6. No support after counting ends

Once the audit is done, most providers leave. Store teams are left to deal with the same inventory reconciliation problems on their own.

The result is predictable. The Traditional inventory audit process shows what is missing, but never prevents the problem from returning.

Why Inventory Audits Lose Store Owner Trust

When every audit highlights shortages without explaining their causes, store owners stop relying on reports to guide pricing, ordering, and investment decisions.

Over time, confidence in inventory data erodes, and audits begin to feel like recurring problem reports rather than tools for improvement.

At this stage, audits stop supporting growth and only document ongoing problems.

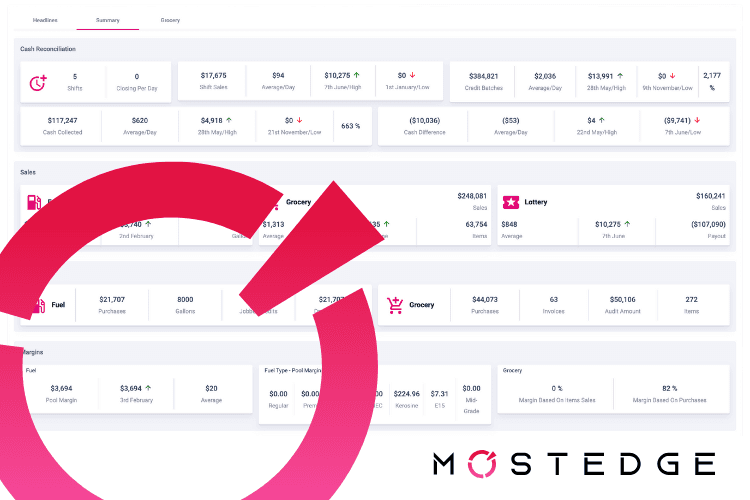

How MostEdge’s Stock 360 Audits Work Differently

Stock 360 does not claim to monitor inventory every day. Audits still happen monthly or quarterly.

The difference lies in how audits are analysed and supported.

Instead of treating each audit as a standalone event, Stock 360 uses data from previous audits to identify trends, patterns, and likely causes behind discrepancies.

How Stock 360 Solves What Traditional Audits Leave Unfinished

MostEdge’s Stock 360 moves beyond product counts and focuses on action. This approach turns audits into a decision framework by linking inventory data to operational actions that reduce repeat losses.

With Stock 360, store owners receive:

- 98–99 percent accurate store and category valuation based on verified physical audits

- Clear direction on what to order and what not to order, reducing blocked cash

- Identification of active versus inactive items, helping clean up POS systems

- UPC codes issued for local products, bringing them into proper tracking

- Instant, location-wise reports immediately after the audit

- Analysis of potential shrink causes using historical audit data

- Seven days of post-audit monitoring, ensuring stores are not left alone after counting

Instead of repeating audits with the same outcome, owners gain clarity on how inventory behaves between audits and where operational gaps exist.

Conclusion: Counting Alone Is Not Control

Traditional audits focus on counting. Stock 360 focuses on understanding. By analysing past audit data, improving valuation accuracy, and supporting store teams after the audit, Stock 360 turns inventory audits for convenience store owners into a practical decision-making tool.

Store owners gain confidence because they know:

- What their inventory is actually worth

- Where shrink is likely coming from

- Which products deserve shelf space and cash

- What actions to take after the audit

Book Stock 360 to transform audits from repetitive counting exercises into clear, data-backed inventory decisions.